The

business of business is business and how you make the most out of your business is again a big business. From fashion show ramps to company boardrooms, the mantra is clear. And once you know that, the reasons for haute couture king Tarun Tahiliani choosing ‘Big Sister’ Shilpa Shetty and not others, for showcasing his collection; and for international private equity giant Blackstone betting on Gokaldas Exports and Nagarjuna Construction, and not others, to invest (read, park their funds), are perfectly simple to figure. It’s business, straight and simple.

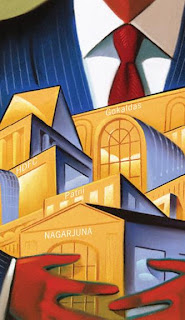

business of business is business and how you make the most out of your business is again a big business. From fashion show ramps to company boardrooms, the mantra is clear. And once you know that, the reasons for haute couture king Tarun Tahiliani choosing ‘Big Sister’ Shilpa Shetty and not others, for showcasing his collection; and for international private equity giant Blackstone betting on Gokaldas Exports and Nagarjuna Construction, and not others, to invest (read, park their funds), are perfectly simple to figure. It’s business, straight and simple.Both, Shilpa and Gokaldas & Nagarjuna Construction are well established brands in their respective domains and there exists no question of any default from their end. In fact, both will actually give their new backers handsome return on their investments. But the question that begs an answer is another, more pressing one. Do companies like Gokaldas or Nagarjuna construction really need Private Equity (PE) money? Like Gokaldas exports, Nagarjuna Constructions too is an established player in the industry. Further, since both are listed entities, they could have raised money by any other means, including by an FPO, rights issue or an alternative listing. So, why an investment by a PE player, which simultaneously makes them lose some iota of control over their company’s management?

For more articles, Click on IIPM Article

Source : IIPM Editorial, 2008

An IIPM and Professor Arindam Chaudhuri (Renowned Management Guru and Economist) Initiative

For More IIPM Info, Visit below mentioned IIPM articles.

The Sunday Indian - India's Greatest News weekly

IIPM, ADMISSIONS FOR NEW DELHI & GURGAON BRANCHES

IIPM, GURGAON

No comments:

Post a Comment